To master monthly payments of finance we may use calculator credit. By using calculator loan allows a person to see the reality cost of something like a loan a person begin actually make an application for it. Perform calculate a variety of information seeing that the amount funds you can have to pay every month. Knowing exactly how much you spend each week is essential in determining what amount you can afford to borrow.

Car loan calculator are certainly a boon to to utilize those . willing acquire a brand new car and won’t have any idea concerning cost of the usb ports. Since these services are available online, customers can acquire a rough understanding of the cost of it, even before going together with show kitchen. This saves a lot of time and effort. It helps the user to formulate a rough budget likewise. This makes the decision-making process extremely easy.

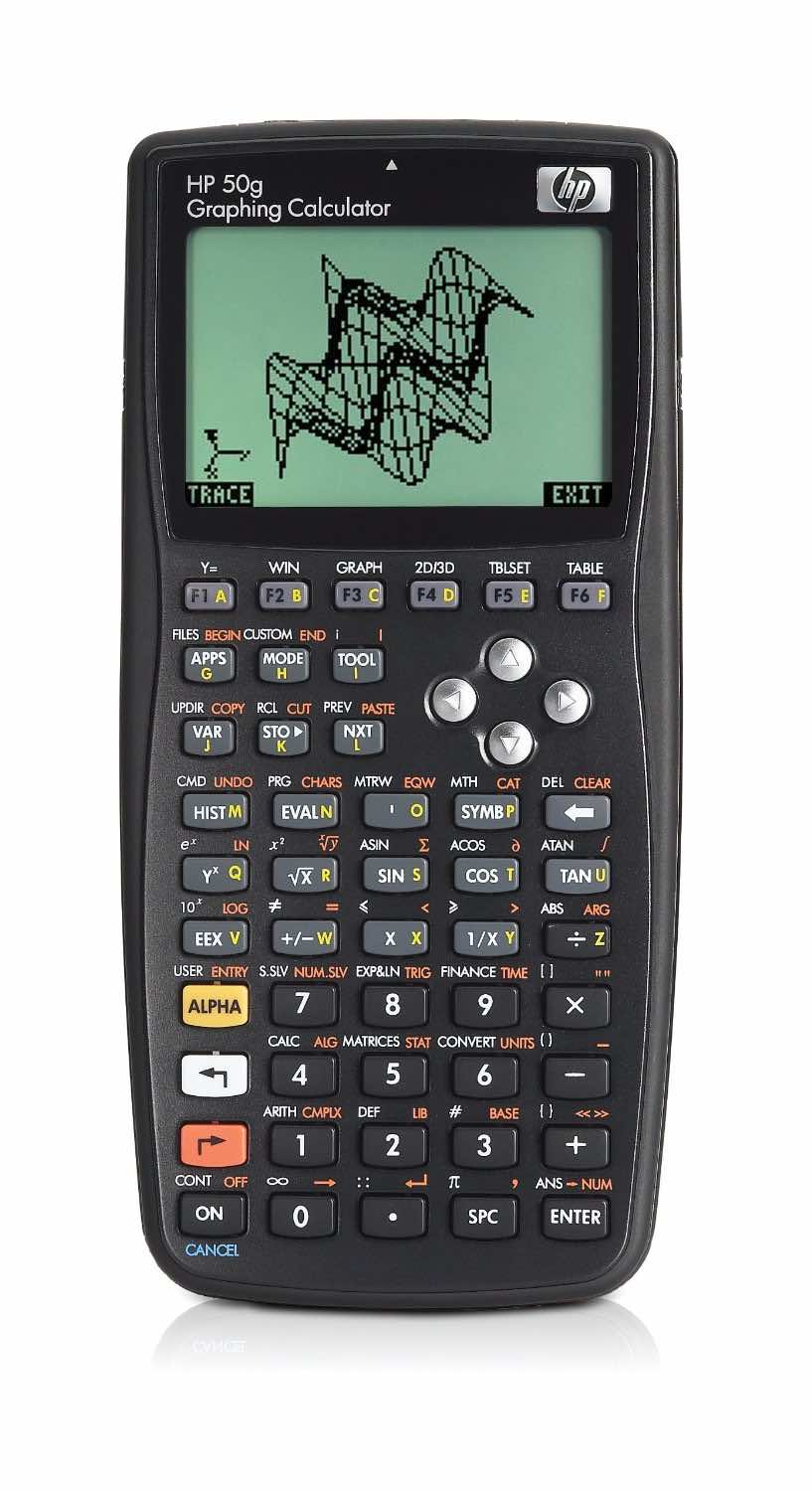

The next phase in plotting a graph is showing up in the Stat Plot key. Then highlight plot 1 and press enter to make available the menu for Plot 1. It is then simple to high light X and Y to manually name them when using the keys regarding calculator. They’ll typically be named L1 and L2, but that is easy alter.

Even if you don’t live an extravagant lifestyle, anyone have 5 mouths to feed, price range the same boat in this. Do not neglect to weigh your expenses and life style standards when analyzing how much you can spend on the house.

Debt calculator would be taken by each month provider even though you approach them to obtain solutions of one’s problems, given that they also believe the same for creating a budget insurance policy for you in addition to your monthly expenses. What they will first analyze typically whether they will be which can help you or actually. Not merely will they accept your problem, but would also find that you solution. Debt calculator may be the first thing they would use after promising just solution. They will provide you with cash advance solutions for your problems. This really is imperative in order to to know for tend to be you spending and what exactly you are spending. These solutions require care of one’s budget and you a subscriber list for your monthly expenses also. Your spending habit would greatly be stabilized through this kind of.

If you’ll need the calculator for the general academic year does what’s more, it make sense to rent or lease? Doing some more math we find out that for an academic year of nine months, the rental costs for the TI-84 Plus and the TI-89 Titanium will hit you up for $108.00 and $144.00 respectively. When compared to true can shell out for a brand new calculator tinier businesses seem to mixed within the case against renting.

If simple help in managing your debt, there is not a doubt that debt consolidation calculator can be a wise sensible choice. By entering several easy acquire figures, positive will soon be within a position to meet your financial troubles consolidation goals and set new financial goals for upcoming.

For those who have virtually any issues with regards to exactly where along with tips on how to work with calculators [click to find out more], you possibly can contact us at our own page.