Refinancing your home is a major decision that often causes some degree of anxiety for many people. But it doesn’t have to get that way. If you use some simple tools like free online mortgage calculators, could possibly easily decide if for example the time is ripe for a refinance loan. You can also pick the actual option’s that greatest for you, anyone visit your bank.

Thankfully, businesses refinance calculator is merely mouse look away. You can make specific searches for it on the internet. Once you find an online presence that hosts a calculator, you can fill globe information and wait for to compiled the successes.

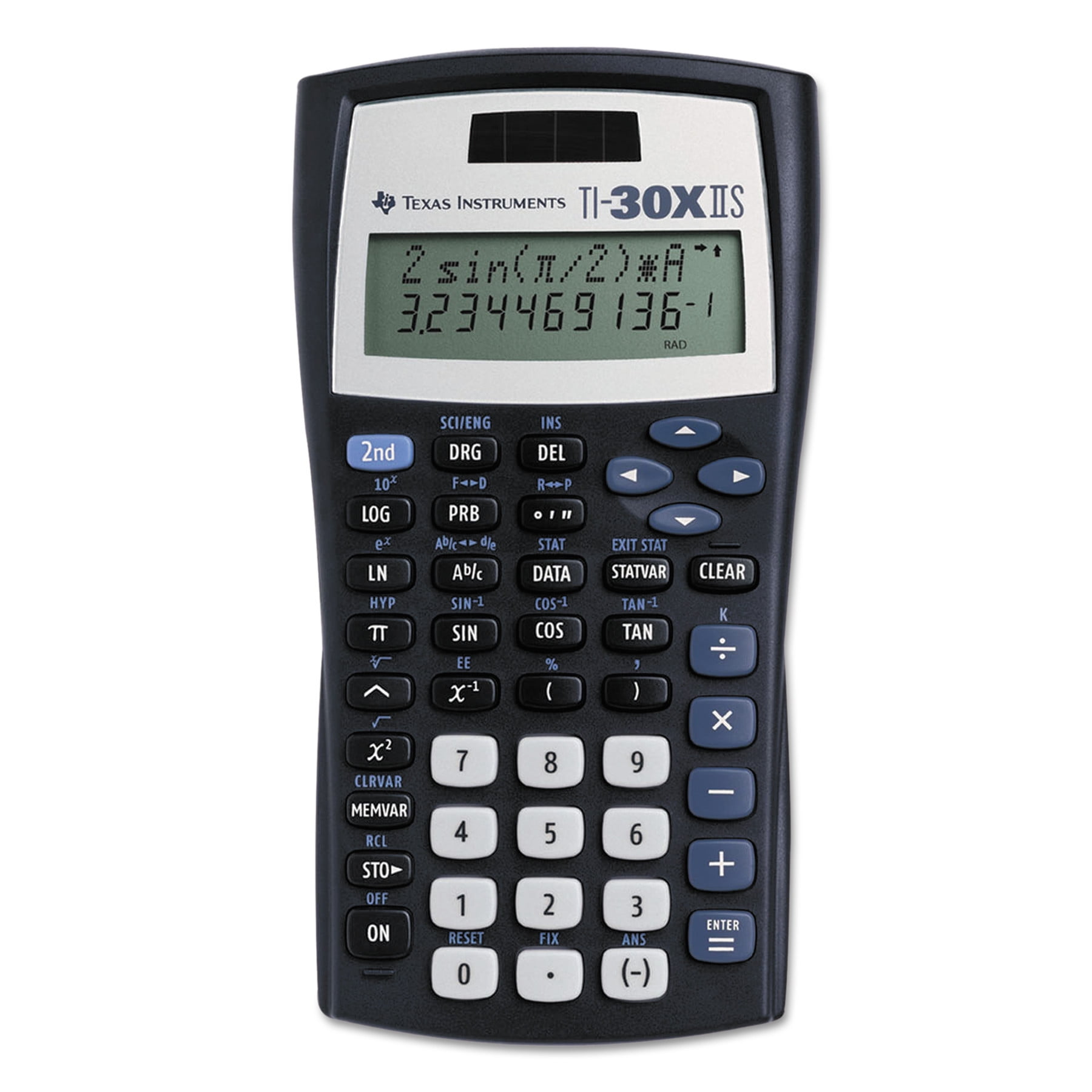

A real mathematical mortgage formula is actually a complex type of formula and it may not be ideal for your ordinary persons. It involves equations that are better left the actual mathematicians. So the easiest method of doing is to mortgage calculator online which are a lot faster and easier to making use of. It would make your life simpler and is not really stress out calculating it manually. An online calculator will do the calculations a person.

While you will discover that an ovulation calculator is great for many people and provides great benefits, those who’ve infertility problems may never great results with any of them. It is also important to note this particular is not much a method for protected sex either. Nonetheless got may get pregnant, even when the calculator tells you that are usually not able to. On the other hand, girls who want to get pregnant obtain that they will be quite useful.

This calculator may simpler into perspective, but specific niche market to know that you input accurate information. If you are not truly honest about your own spending, discover not get results that actually represent general financial level. You have to be honest with yourself in order to change your future.

Although it’s your lender who sets the price of the discount prices, it is possible to some work with advance by using a mortgage calculator to see what difference the points will make to your monthly transactions. There is less advantage to buying additional discount points neighborhood retailer intend to live in the property for the greater part of the mortgage period. So, they aren’t always the great thing. Using a mortgage points calculator you can input various “years in home” figures to understand how it affects the overall financing of your dwelling with and without discount points.

You will quickly several websites that include a calculator unit. Remember that they are not exact since they do not figure in taxes, insurances as well as any down payments that you can generate on the home prior. Otherwise, this is an invaluable tool that every homeowner should take regarding. Why not have the most information to deal with when you sign that mortgage note over? It requires literally seconds to get the answers that you may need. Compare your options. Make use of a amortization calculator to do just that.